EA Drives A Generational Shift In Sports Media

Why deal with The Athletic and Saudi Arabia's PIF suggests patient capital plus gaming infrastructure put EA in place to transform the sports media landscape

Today EA Sports—a subdivision of Electronic Arts (EA)—announced that it will include The Athletic’s written and video content feature in the soon-to-be-released EA Sports App, announced last month. This new app will deliver “real-time sports coverage with interactive social features, offering a unique experience that combines live sports updates, fan engagement, and gaming elements from EA’s popular Ultimate Team mode.”

This partnership is a perfect example of the “invert your business model” strategy. The Athletic delivers national and local journalism for fans of teams. EA Sports is aiming to “carve out a distinct niche” in a “competitive” sports market long dominated by ESPN and Instagram.

The Athletic video and text content will live outside the NYT paywall and within the EA ecosystem both via the app and “key EA Sports video games, including EA Sports FC 26.” The Athletic “will be a major source of soccer news and updates in FC 26 Career Mode, and will be visible across EA Connect.”

While this does not create entirely new products—as IAC Chairman Barry Diller suggested with his White Lotus and Casamigos examples—it does integrate existing traditional sports journalism into the radically new and different context of social gaming. This partnership is more than traditional syndication—it is a new example of legacy media successfully finding hospitable territory in sports gaming.

It is also an example of legacy media management knowing how to do so: The New York Times’ rationale for the $550 million acquisition of The Athletic was participating in “fandom” because it is “so huge”.

While there is no available economics on the deal, The Athletic “participating” in sports gamer fandom at scale: The app starts with an existing user base of 265 million users in its EA Sports Player Network.

Saudis, Sports & Gaming

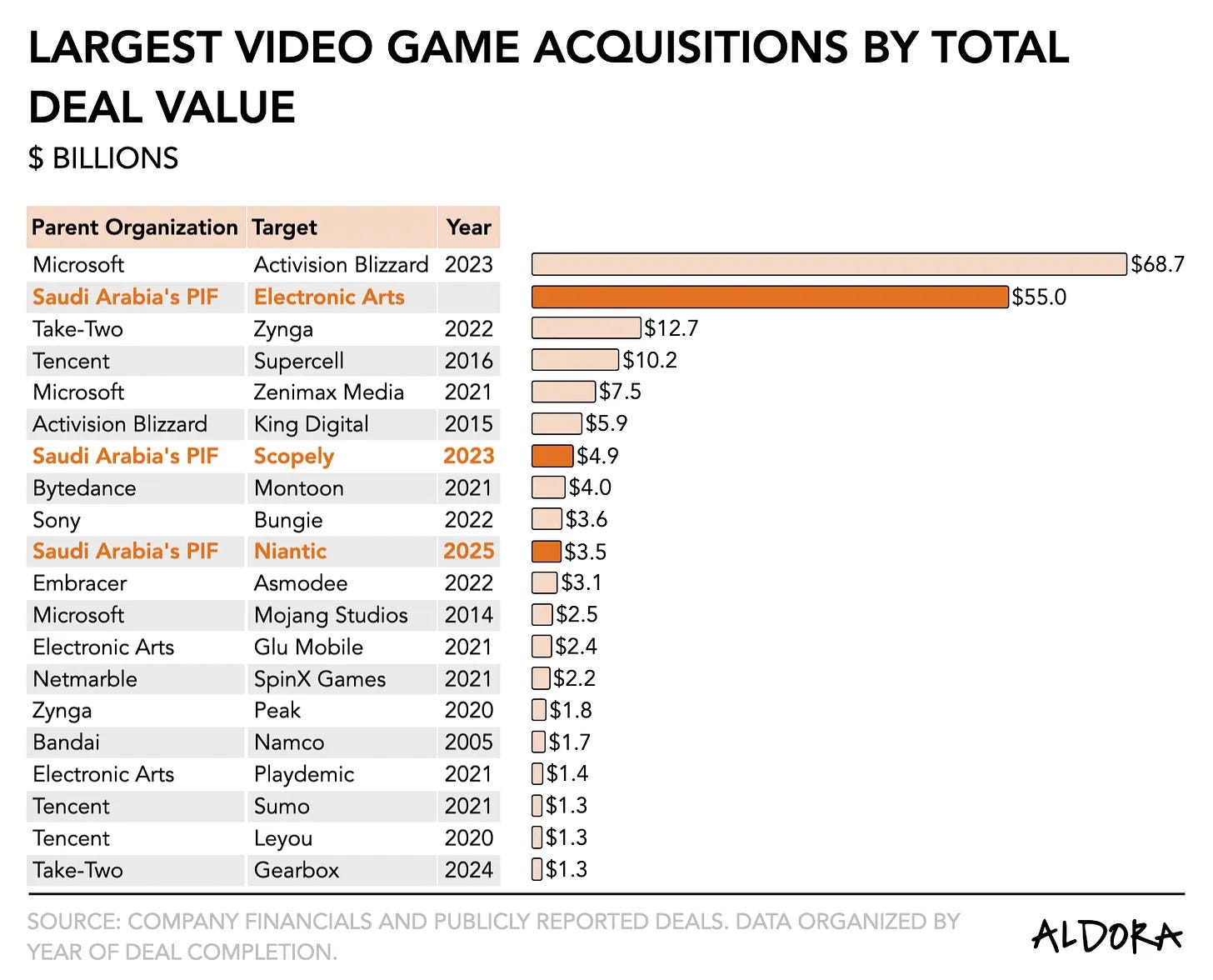

Two weeks ago, EA announced it had agreed to be acquired by an investor consortium comprised of Saudi Arabia’s Public Investment Fund (PIF), private equity fund Silver Lake, and Affinity Partners, the investment firm founded by Jared Kushner. It was an all-cash transaction that valued EA at an enterprise value of $55 billion, making it the second largest acquisition of a gaming studio—in the history of the video games industry, behind Microsoft’s acquisition of Activision Blizzard—and largest leveraged buyout ever, not adjusting for inflation.