The $210 Billion Blind Spot

KPMG data shows Netflix captures more engagement with less investment—but content spending is just one constraint. How to identify the structural factors these financial metrics miss.

[Author’s Note: Paid subscribers will see short summaries of both office hours and advisory services at the end of this email. Based on recent conversations, strategic misalignment is becoming clearer to me but not necessarily my readers. I am now offering office hours to help readers go deeper on the news and get more clarity. Platinum subscribers will get the first hour free of charge.]

Yesterday, KPMG released “Money in Motion: The Future of Content Spend and Business Models in Media”.

Its objective is to highlight how there is “more deliberate investment” in content, despite a growth in spend. That in a broader context it is an example of concrete signals of structural misalignment that are emerging between legacy media and direct-to-consumer models emerging. David Atlan-Jackson, Chief Content Officer at Vuelta Group—a European film and TV studio— told San Sebastian’s Creative Investors’ Conference:

“The audience has become very selective and knowledgeable. The main challenge is to give them content that they can connect with. There’s no more space for tepid or lukewarm content. You have to stand out for one reason or another.”

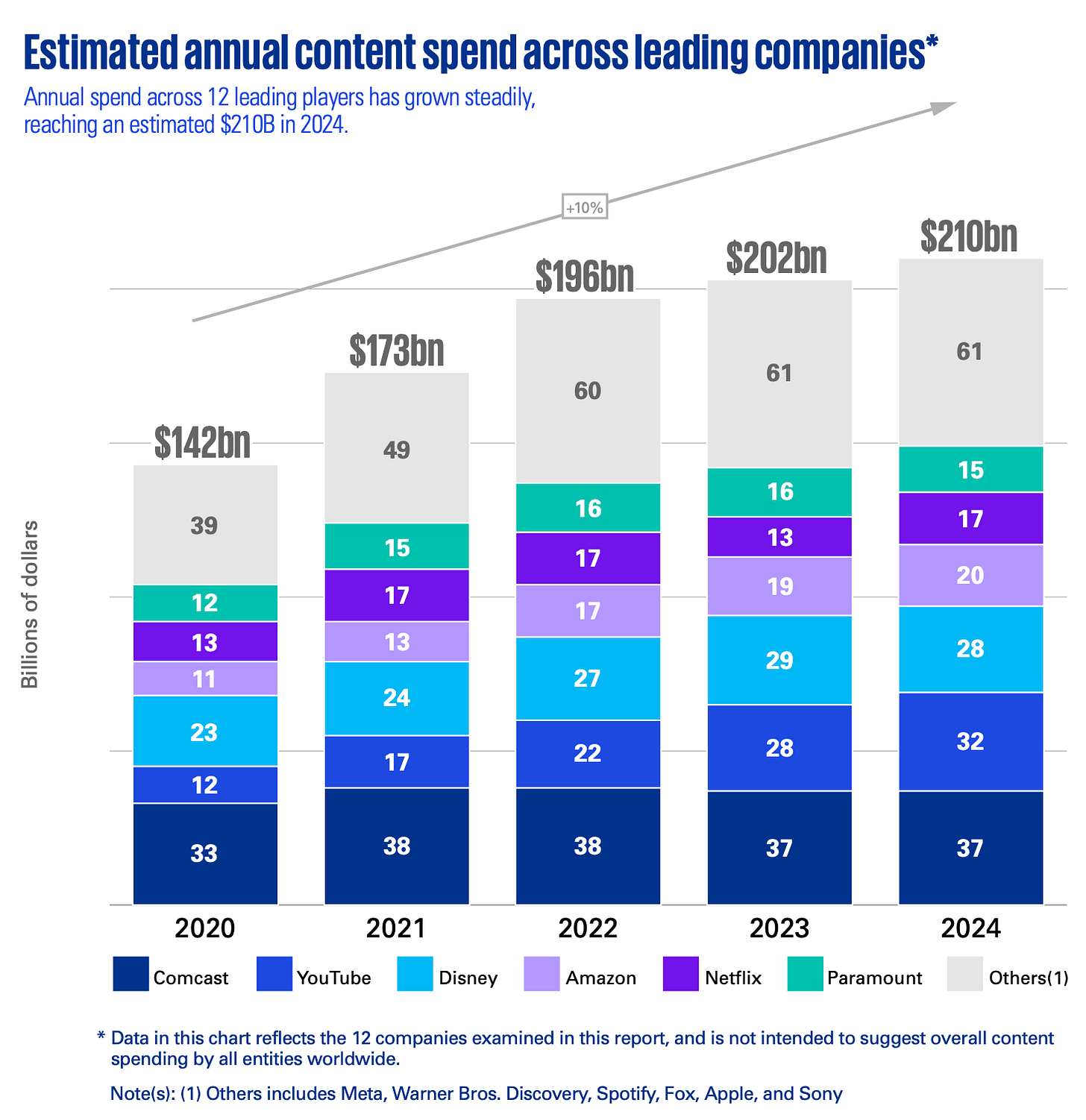

Former WarnerMedia CEO Jason Kilar tweeted another version of this argument yesterday with a chart from KPMG’s report (below) comparing total annual content spend across 12 media and technology companies, including Netflix.1

He argued it is “counter-intuitive” that Netflix captures “far more consumer time digitally than any of the Hollywood incumbents” after investing “less absolute” dollars annually “in series/movies/sports/docs than most of their peers do.”

More spending does not equal more success. He argues “the secret” to Netflix’s success is two-fold:

They channeled the “totality” of its investment into (a) “a financially powerful business model (global streaming)” and (b) “a user experience that is attracting more consumers and earning more time spent each day”; and,

They do not license “their series/movies/docs/sports to their competitors.”

In Netflix’s model, both content spend and research and development spend ($2.92 billion in 2024) are directly correlated with the core metrics of the business. However, in the legacy models, content spend is a lump sum of broadcast, cable and streaming rights and research and development can include anything from theme parks (Disney, Comcast) to developing new technologies. So, the spend summarizes multiple different businesses but has a weaker correlation to the core metrics of the business.

As we learned with “The Curse of the Mogul”—the problem of legacy media CEOs who pursue creative businesses that they believe are not subject to traditional strategic, financial or management appraisals—increased spending on content tends to benefit creators more than shareholders. That has not been the case at Netflix, which has seen it stock rise by 150% over the past five years while its legacy media competitors have seen their stocks drop or remain flat.

So, if a management team believes competing with Netflix head-to-head is in the best interests of shareholders, content spend on its own does not reflect that objective. It must act in the best interests of shareholders.

To do so, it must be better at identifying structural misalignment.

The Medium’s New Market Alignment Test

Last month I argued that one approach was to identify whether the management team has a direct-to-consumer (DTC) skillset. Also, it was worth looking at whether they have taken an early adopter approach and have been quick to embrace new technology, or whether they have pursued litigation instead. I suggested management could be lumped into three categories:

Aligned: Early adopter ready to partner, invest, or acquire, DTC-or-gaming-savvy management in the C-Suite

Neutral: “One foot in”, wait-and-see approach, move when peers validate success, also litigate

Misaligned: View AI and creator economy as existential threat, will sue or protect intellectual property (IP) aggressively, actively impede DTC-savvy management from assuming C-Suite responsibilities.